Robotic Process Automation brings several benefits to organisations. Here are the top 11 processes RPA can execute for business.

Post summary:

- What is robotic process automation?

- Why do companies invest in RPA?

- Eleven RPA use cases

What is robotic process automation?

Robotic process automation (RPA) is the use of specialised computer programs, known as software robots. These robots automate and standardise repeatable business processes that are typically carried out by employees.

The sector is huge, according to research from Forrester, the industry is expected to reach $2.9 billion by 2021.

Imagine a robot sitting at a desk using the same applications and performing the same tasks as a human employee would.

Robotic process automation is not physical robots. It is where a virtual robot mimics human activities by interacting with applications in the same way an employee would.

Except it does with the same speed as a computer system.

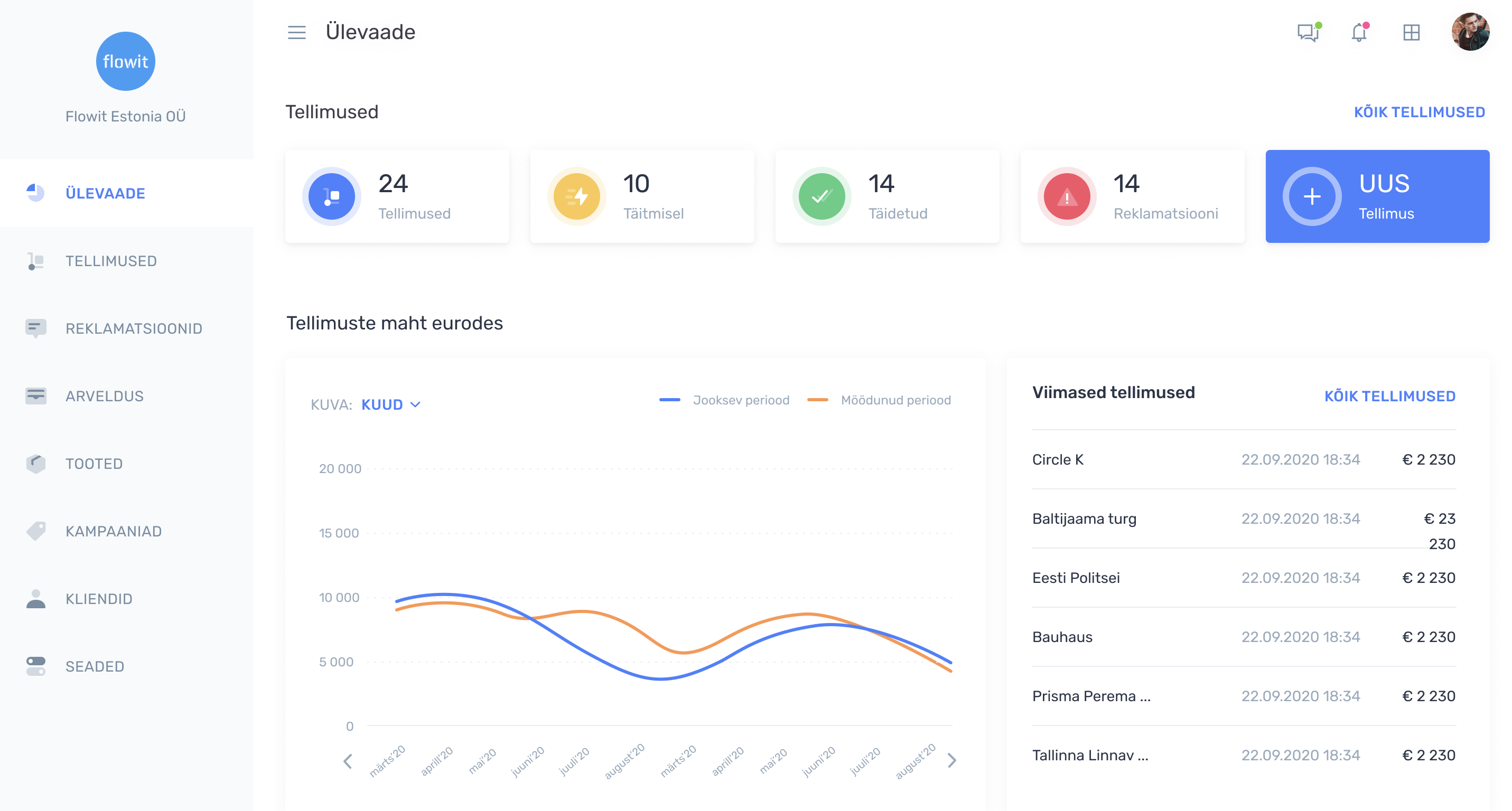

For example the most efficient software robot Flowit developed performed the tasks of approximately 1,100 human worker equivalents every single day.

Supporting as a virtual robotic assistant, these bots take on monotonous tasks, freeing up time for workers to engage on more revenue-generating tasks.

Furthermore, RPA integrates well with existing IT infrastructure, Even working across different platforms, applications and departments. Even legacy applications which are extremely costly to update.

Companies do not have to heavily invest in automating processes, yet those who do witness surmountable benefits.

Why do companies invest in RPA?

Robotic process automation is both cost-effective and user-friendly. Its advantages are drawing interest from organisations across several industries.

These benefits include:

- Increased accuracy. Bots are incredibly accurate and consistent – they are much less prone to making mistakes or typos than a human worker. Virtual robots apply conventional processes like adding or removing user accounts. Including copying information from one system to another, onboarding employees or populating a form based on information from other systems.

- No interruption of workflows. Virtual robots operate 24/7 without staff initiation or further interruption.

- Meet regulatory compliance. Configured bots follow instructions and provide an audit trail for each step. Bots can also re-play their past steps in case a process needs reviewing. The controlled ‘robotic’ nature of their work makes them ideally suited to meet strict compliance standards.

- Work within existing parameters. Traditional automation initiatives need extensive IT resources to integrate across multiple applications. Robots do not; they work across the layers of existing applications as a person would. This is particularly useful for legacy systems, where APIs are not available. Alternatively, in organisations that do not have the resources to develop deep level integration with existing legacy applications.

- They improve employee morale and experience. Employees invest more time and their talents into more engaging and strategic work. Bots enable workers to offload manual tasks like filling out forms, data entry and searching for website information. Employees can focus on strategic, revenue-producing activities instead.

- Increased productivity. Process cycle times are more efficient and completed faster compared to manual processes.

RPA technology has advanced significantly and is adding more value all the time.

Advanced cognitive capabilities like artificial intelligence and machine learning allow bots to interpret the interfaces they work across intelligently. Virtual bots are better able to handle errors and sift through unstructured data.

Machine learning allows bots to recognise patterns over time, meaning that when a process requires human intervention, a bot learns and acts autonomously when the situation arises again.

Eleven RPA use cases for business

Sales Orders

Data consistency across enterprise-level platforms is a very tedious task. Sales representatives need to spend their time entering data into a CRM system plus an ERP system.

Finance analysts have to replicate that data and enter it in another system or module.

This results in duplication, produces errors and impacts productivity. RPA can automate such tasks and perform end-to-end sales activities like data entry and invoicing. Furthermore, bots can maintain a database by removing duplicate data.

By eradicating time-consuming tasks, employees focus on their primary tasks, generating more revenue.

Marketing: Lead Generation

Lead generation is an essential part of today’s marketing processes. Marketing teams create new entries for potential leads within a CRM system gathered from outside sources.

Some CRM platforms offer their own built-in data upload tools. Most legacy platforms need users to enter each new lead’s information by hand. Thus decreasing the time staff has for other tasks and increasing the chance for error.

Take, for example, a firm that attends industry conferences to gather potential leads. They would enter each prospective customer manually into their CRM system.

With RPA, users can program software to import the data from their spreadsheets. Being faster and with a higher level of accuracy than by hand. Once again, the staff can focus on engaging with lead prospects instead of data entry.

Invoice Processing

Invoice processing often contains repetitive manual tasks, resulting in delayed and inaccurate payments.

Timely payments can deliver quality goods and services from the vendor faster.

High volume invoice processing has many challenges. These include invoice formats, data from various sources, reconciliation procedures and entry into one database.

RPA automates invoice processing – formatting the data input, reconciliation errors, and even process precise decision-making, minimising human intervention.

RPA automates the end-to-end process from receipt to payment.

Processing Refunds Faster

A company’s reputation depends on how fast it can remedy its errors, and refunds are one example. Customers demand this process to be seamless, fast and pain-free; however, this is easier said than done.

Complaints and return requests generate much data that can be tiresome to sort through. RPA deals with the matter and processes the refund without delay. Improving customer satisfaction and having a positive impact on a brands reputation.

Payroll

Processing payroll every month is a time-consuming, repetitive task for the HR team in every organisation.

Payroll involves a significant volume of data entry. Often resulting in data inaccuracy causing delays in payment and employee dissatisfaction.

RPA verifies employee data consistency across multiple systems, validating timesheets, load earnings and tax deductions. Virtual robots can automate salary slips, administer taxable benefits and other reimbursements.

RPA automates payroll-related transactions from end-to-end to avoid inaccuracies and delays.

Financial Reports & Accounting

At the month’s end, or after each quarterly period, is a stressful time for those working in finance and accounting, who are frantically compiling various sources of information for companies.

RPA can analyse past historical and current market trends to make forecasting assessments of the company’s financial health, providing variance reports. Furthermore, RPA can download monthly sales data and calculate sales commissions owed, make payments and record all financial data.

RPA automates the aggregating of financial data in a fraction of the time, leaving accountants to leverage that information for insights and forecasting.

Customer Service

Fast responses are what today’s customers expect, with a solution following quickly behind. RPA makes it possible to deliver top customer satisfaction and what customers want.

Automated customer care systems can filter queries and offer initial responses to customers. RPA categorises queries and sends them to the right department, such as the tech department, service department or sales.

Sorting ensures that the right customer care agent is selected for a quick resolution. There is no need to transfer a customer’s call from one customer service agent to another.

Customer service contains several rules-based processes that could be streamlined. According to recent research, 70% to 80% of rules-based processes could be automated, and it is a good idea to begin with customer service.

Storing Data

Looking at RPA use cases, it can store, sort, organise and make accessible all kinds of business information very easily. Systems can categorise different data ranging from contact information, purchase history, preferences, HR information like birthdays or contracts.

When data is sensitive, then there is a need to automatically obfuscate data due to data privacy concerns. The data does not need to be hidden but merely anonymised.

This data can then be either locked or displayed according to the privileges of various job roles.

So customer care agents, salespeople, HR and senior management can equally access but not share sensitive or obfuscate data. There is no need to enter this information or worry about its accuracy or sensitivity.

Storing information is one of the most labour-intensive jobs and can cause much stress. RPA use cases have reduced repetitive tasks by up to 80%.

Price Comparison

Businesses have to make purchases in bulk to manufacture products or provide services.

The cost of these items impacts a company’s revenue or profits. Company staff always research online to make an informed and hopefully cost-cutting decision.

Researching is time-consuming and complicated, which is why we can see it as different RPA use cases in many companies. Virtual bots compare prices from different vendors by their quality and product attributes. Businesses then buy the best products at the most competitive.

Recruitment

RPA can also help with recruitment, streamlining the process. It can source resumes from various platforms, access their value, wade through spam or unwanted applications.

RPA streamlines recruitment by a considerable margin. Reducing the stress of recruiters and allowing them to thoroughly assess every applicant.

Virtual robots could administer 90% to 95% of vital recruitment processes like screening, assessing, measuring and onboarding.

IT: Adding New Users

IT departments spend more time setting up user accounts for new employees and application-specific profiles for current employees.

This kind of work ties up highly skilled workers doing low-value, repetitive tasks. Also, some systems do not include the functionality to run back-end automation scripts.

For example, an IT department may already have an automated system in place for new user account provisions.

In essence, a user submits a request for an account on a particular system. Once the system administrator approves the request, the account is created. For the process to continue, an automated email is sent to the administrator to confirm user permissions. Finally, IT can configure user security permissions.

To speed up the process, a virtual bot can perform the administrator’s actions during the configuration step. The only manual work IT has to do is to approve the request.

Processing HR Information

Storing and processing HR information is challenging. It takes a lot of time and can be a tedious process.

A successful business generates vast amounts of employee data, that is challenging to filter and organise. RPA can collect and organise all the information an HR department requires.

Employee history, payroll, reimbursements and training levels, can be sorted through using RPA. It can handle all the day-to-day tasks and allow HR employees to focus on human-to-human interaction.

HR personnel can prioritise improving employee productivity, workplace culture, and finding new talent.

Extract Data in Different Formats

Data appears in varying formats, ranging from editable, scanned text to handwritten notes. Data entry workers grapple with reading the information and inserting it into the system.

RPA can use Optical Character Recognition (OCR) technology to read various information formats. Once scanned and processed, can enter it into databases.

Employees spend around 10% to 20% staff-hours on recitative computer tasks. Saving all that time and directing it towards something more productive.

Automating this process accurately stores information, returning a significant investment for an organisation.

Conclusion

RPA use cases can be seen in a wide range of ways to save both time and money, at the same time increasing job satisfaction.

At Flowit, we encourage businesses to adopt Robotic Process Automation. We recommend implementing system-wide automation from the entire outset.

Alternatively, start small and automate one process at a time to determine if it is the right choice for an organisation.