This article was initially published by our client, Robby & Bobby, for whom we have built various accounting automation solutions.

Accounting has undergone tremendous changes in the last 30 years. Accounting done on paper has practically disappeared. Much like taking physical payment order forms to a bank. Thanks to software that is able to read purchase invoices and is compatible with banks, accounting has become significantly more automated and time spent on accounting has notably decreased. Let us take a closer look at how to automate your accounting, more specifically your sales transactions.

The first step in accounting automation: cast paper aside. Giving up paper saves a great deal of time, as well as money previously spent on paper, paper folders, and storage space. Storing electronic invoices has also been completely accepted by the tax authorities for several years.

Issuing single service invoices

Service invoices can be very conveniently issued directly from an accounting software program. Beautifully designed invoices have mostly fallen into disuse anyway and only data are exchanged. Thus, a brief sales invoice issued by an accounting software program that contains all the necessary data is generally well suited.

Some programs let you define articles, such as Consulting Services Estonia and immediately associate the correct income account of the income statement and VAT rate with it. This greatly reduces the work of the accountant in checking the invoices issued.

Benefits of invoicing directly from an accounting program:

- convenience – an invoice can be prepared and issued from one place

- the timely receipt of the invoices can also be monitored from there

- an easy option for sending reminders (if needed)

PS! Good practice dictates that monthly sales invoices should be issued at the end of each month, not the beginning of the next month. This allows both the seller and the buyer to close their month faster.

Issuing recurring service invoices

Several programs allow you to save templates and issue recurring invoices automatically based on a predefined schedule. This is very convenient, for example for membership fees, fixed monthly payments, etc. If your company uses recurring invoices, select a program which enables it and gets this job done – it will save you a lot of time in the future.

Issuing e-invoices

An e-invoice is not a PDF but a machine-readable invoice. The information on it is easily readable and there is no need to digitise or manually enter anything. If the recipient of the invoice is able to receive e-invoices (this can be checked in the e-Business Register), you should definitely issue invoices as e-invoices. Sales invoices to the public sector can only be issued as e-invoices as from 01/07/2019, so we are finally reaching a point where e-invoices are becoming more widespread.

You should ask the developer of the program about the capability to issue e-invoices. Although some programs let you issue e-invoices without entering into an additional agreement (e.g. Merit upon agreement with Omniva; e-Financials), most of the time you have to conclude a contract with an operator such as Omniva, Fitek, Telema or e-Financials to issue e-invoices.

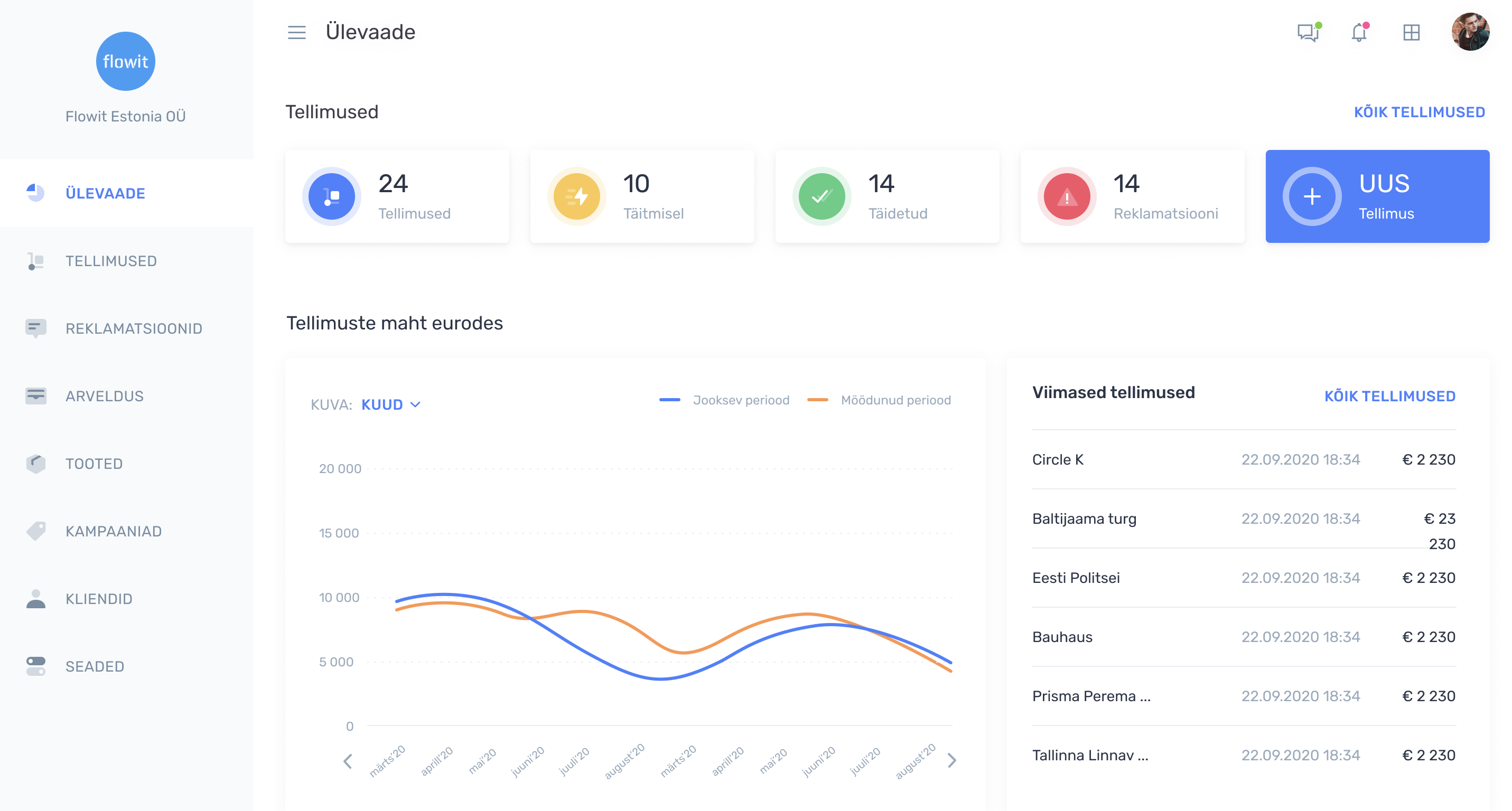

Recognition of sales in an online store

Sales made in an online store should be sent to an accounting software program through an API. Find an accounting software program that is compatible with the respective online store. The benefits of using an API include significant time savings and error prevention and it can also be used to forward detailed sales information to the accounting software, process this information, and conduct the necessary analyses.

What is an API?

To facilitate information exchange between the two programs, they both need to have the necessary gateway (API) for open communication and the other program needs to be given an API key to open the gateway. Both of the programs grant the other one permission for data exchange through the key. Settings determine how much data can be exchanged.

Data exchange is organised by a special little program (interface). Sometimes this interface is built into one of the programs, sometimes it is provided by a third party and sometimes you have to order it yourself. Creating an API is usually not a very large-scale and expensive job, but, as always, its profitability should be evaluated.

Forwarding sales transactions from a self-developed platform

The method is the same, data should be forwarded via API. As you have developed the sales platform yourself, you have more opportunities to choose the level of detail of the data being forwarded and you have more control over these data.

Alternative to API?

If you do not have an API, you can also transfer data from one program to another in a file form – you export it from the sales software, process it if necessary and import into the accounting software.

Note! If sales (and stock records) are conducted in another program, it is very important:

- to apply strict deadlines and close the forwarded period in the sales software. Once sales data from May have been sent/imported, May is closed and can no longer be edited. All necessary corrections must be made the next month. Otherwise, differences with the accounting software will arise and it will take a lot of time and effort to find and correct these differences.

- In addition to establishing and implementing rules, it is essential to regularly compare the data. Both people and software programs sometimes make mistakes and new data can even creep into a closed period through the keyhole. Ensuring data consistency between the two programs is a very important job. This requires the accountant to work accurately and be able to use programs correctly.

If you have not begun automating your business yet, start by mapping out how different transaction information is currently being recorded.

Sketch out the sales, purchases and bank transactions and think of the following:

- how could the data flow?

- what programs could be used?

- what connections do you require?

If you are having trouble choosing the right accounting software or have any other questions about sales transactions automation, please contact us.